Four Factors are Creating Energy Efficiency Opportunities for Commercial and Industrial Property Owners in 2015

Executive Summary: Four factors are now perfectly aligned to create significant energy-saving opportunities for commercial and industrial property owners in 2015. They are (1) The sheer number of buildings built prior to 1999 that, on average, consume 67% more energy than those of newer construction. (2) Removal of the greatest barrier to energy efficiency projects – the initial upfront capital and development costs. (3) The meteoric rise of long-term funding available for energy efficiency projects. (4) The decreasing cost of a growing number of technology choices that foster energy savings.

The 4 Factors

Abundance of Older Energy Wasting Buildings

In an article by Bradley T. Carmichael, PE, the author details the improvements in building codes that are driving reduced energy use in newly constructed buildings. He describes the rate of improvement in energy consumption resulting from adoption of the new codes. They have changed dramatically – buildings constructed as recently as 1999 generally consume 67% more energy than those buildings conforming to today’s standards. That “more energy” factor is increasingly greater for buildings that are even older.

“Older buildings far under-perform new ones in terms of energy efficiency, yet they constitute the bulk of existing building stock.” Bradley T. Carmichael, PE

Research reveals that the average age of commercial real estate in the United States is 50 years. This average age, along with Carmichael’s quote, gives a rough idea of the magnitude of wasted energy taking place in the collective commercial and industrial real estate inventory. Most building owners are keenly aware of the wasted energy in their older buildings, and do understand the potential for increased value of an energy efficient building – they are sold or leased for significantly higher prices than their energy-wasting counterparts. The big question is, why don’t these owners upgrade?

The answer is, a major barrier existed resulting in the financial infeasibility of most energy efficiency upgrades and renovations.

Major Barrier to Energy Efficiency Projects Removed

Many energy saving opportunities have stalled on the drawing board because of the upfront capital and development costs necessary to fund and undertake the project. The big questions for energy efficiency projects are always: where will the money come from; when will it have to be repaid; what’s the project payback period and return on investment (ROI)?

In the recent past, funds for energy efficiency projects usually came from commercial bank loans. The typical term for these loans is three to five years, and the maximum available loan for these projects was limited. Therefore large projects did not have access to long-term funding; the relatively short term meant insufficient energy savings were generated to pay for the project before the loan had to be paid off. In addition to an expense that reduced cash flow, these loans created a burden on the company’s balance sheet. An alternative funding model was desperately needed. Access to high dollar funding was vital if larger energy efficiency projects were ever to get off the drawing board.

Large Funds For Energy Efficiency Projects

When the risk of lending money is removed, not only do the amounts available increase, but the terms do as well. Unique, alternative financing models are now available, dedicated to funding energy efficiency projects. What is attracting these large loans is the especially low risk for both the lender and the building owner.

There are a number of alternative funding models, and some may only be available on a local level or for specific industries and applications. One of the up and coming financing options is the Property Assessed Clean Energy (PACE). PACE loans are paid for by a “special assessment” on the building’s property tax. The assessment “runs with the land”, so it moves to the new owner if the property is sold.

The loan is especially low risk for the lender (see video) because it’s enforced by the county in the event of a delinquency. The PACE lender is also “first in line” of all creditors. This is what makes the longer terms – up to 20 years – and lower interest rates possible, compared to most commercial loans.

PACE projects are especially safe for the building owner because the resultant energy savings, by definition, must be greater than the entire cost of the project. This includes any required energy audits or studies, as well as all equipment, installation materials, labor and financing costs. This results in a positive cash flow for the building owner. It’s actually more profitable to undertake these energy efficiency upgrades than not.

This security for both lender and building owner has resulted in an exponential growth of projects utilizing this model. To highlight the exponential growth of the PACE program, here is a graph of the money spent on projects utilizing PACE from September 2009 to October 2014:

Source: PACENow

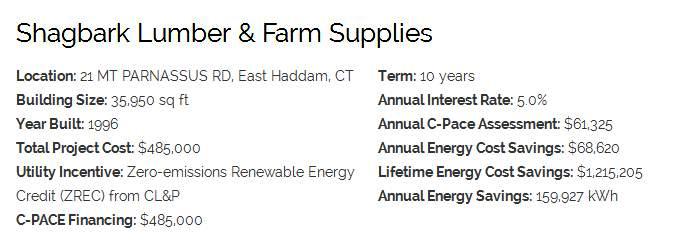

To understand why PACE projects are safe here is a snapshot of the numbers on a recent PACE project funded by C-PACE of Connecticut:

The two important numbers to focus on are the Annual Assessment and the Annual Savings. The “Assessment” is the amount of money that will be paid each year to retire the entire project cost. In this example, the assessment is $61,325 per year. The project resulted in an “Annual Energy Cost Savings” of $68,620, which is $7,295 more than the cost of the assessment. After the 10 year assessment, the owner will be saving almost $73,000 over the entire cost of the upgrade.

Is it any wonder why this funding model is growing so quickly?

Lower Cost and Increased Variety of Energy Saving Technologies

As the cost of renewable energy technology continues to fall, the number of energy efficiency products continues to rise with amazing speed. Lighting is one of the most exciting areas of innovation as new developments in LED lights drastically lower energy use while dramatically increasing the life span of the bulbs.

There is not enough space in this post to even summarize all available technology. If you want to look at a real world example of what’s possible, consider the Bullitt Center in Seattle, WA. The Center has been dubbed the “greenest” commercial building in the world. Built from the ground up with energy efficiency as a guiding principle, the building incorporates an impressive array of energy efficiency technology in all areas of operation. The result is a “net zero” energy building – that is it generates more energy than it uses! A real asset to the community!

Conclusion

These four factors have converged at a time when energy efficiency is becoming better known and valued. The past major barriers to becoming energy efficient have been removed. There are a large number of pension funds, retirement accounts and other funding sources seeking the security of PACE loans. As commercial and industrial property owners begin to understand the economic benefit of an energy efficient property, the number of green renovations and upgrades will rise dramatically, benefiting the community at large.

The Energy Alliance Group of Michigan is a leader in clean energy PACE project development and financing.

Leave a Reply