The least amount of energy at the lowest possible cost

Using the least amount of energy at the lowest possible cost is a smart business decision. When companies begin to realize that upgrading their energy technology results in big savings in the long run, their first question is how to fund the upgrades in the short term. The PACE program is one way to answer that question.

PACE is a no-money-down, positive cash flow option

PACE stands for Property Assessed Clean Energy. It is a cost effective way for industrial and commercial property owners to pay for their energy efficient upgrades and it can fund 100% of the costs! One of the most appealing aspects of the program is that the savings, in relationship to the costs, must be positive from day one as a condition of project approval. These types of upgrades must pay for themselves. It is actually costing you money to NOT initiate energy efficient upgrades when you factor in the loss of the positive cash flow that could be generated from upgrades.

“It is costing you money by NOT initiating clean energy upgrade projects.”

The PACE program is a national program but it is administered at the local level. In a PACE approved district a property owner can use the property tax system to finance energy improvements. The property owner voluntarily takes on a special assessment, which is then paid off as a portion of their property tax bill.

The PACE program helps property owners pay for the energy upgrades but what makes it especially attractive is that it lowers the risk to lenders. Low risk means more money available for upgrades. This unique combination has opened up large opportunities for energy costs saving projects as illustrated by the graph below. PACE projects are exploding due to the fact that they save money and also lower risk!

Source: PACENow

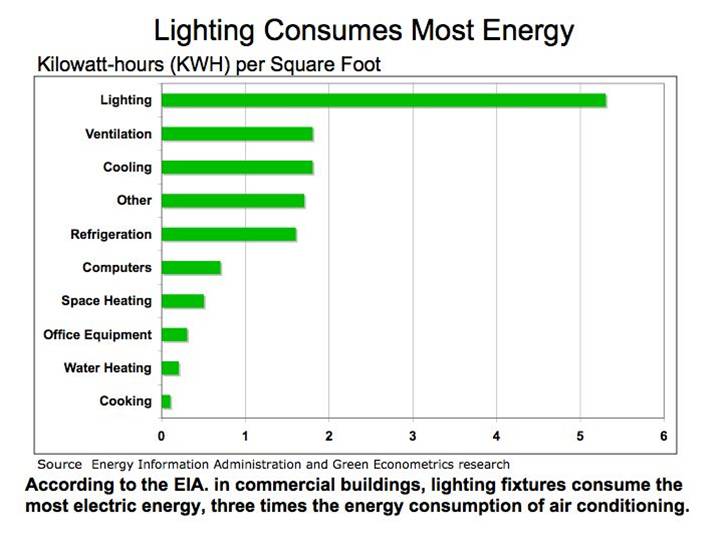

What improvements qualify for a PACE program? Typically it’s for upgrades or construction that reduces energy or water use or generates renewable energy. The energy usage graph below illustrates why lighting is often the first place to consider for an energy efficient upgrade:

The following link illustrates one example of how the PACE program was used to cut electric bills through the installation of solar panels: Tax Programs to Finance Clean Energy Catch On

The following link illustrates one example of how the PACE program was used to cut electric bills through the installation of solar panels: Tax Programs to Finance Clean Energy Catch On

“It’s an idea that resonates and is catching on; I see encouraging signs in the build-out of a whole new approach to funding energy efficiency.” David Gabrielson, PACENow executive director.

If you want to know if your company qualifies for the PACE program, it all begins with a no charge energy audit. Click HERE to take the first step.

As a final thought, here is how one article explained the program’s appeal:

“Because the financing is secured by the County’s property tax authority, lenders provide finance terms up to 20 years, which transforms many energy efficiency and renewable energy projects that are otherwise prohibitively expensive into a no-money-down, cash flow positive proposition.”

The Energy Alliance Group (EAG) of North America is a leader in clean energy PACE project development and financing in Michigan. To learn more about PACE click HERE.

Leave a Reply